HostMonster is one of the best hosting companies all over the world. And its affiliate program is similar to it’s sister company Bluehost affiliate program as they’re the same company and both owned by Endurance International Group. But what of the major problems that newbie affiliate marketers face is how to fill tax form especially for Non-US affiliate marketers as they don’t know how to fill tax form. In this post you will learn How to fill out HostMonster Affiliate Tax form if you’re a US. individual or a Non-US. individual.

Why you need to fill out HostMonster Affiliate Tax form?

Like other affiliate programs e.g. Bluehost Affiliate program and Hostgator affiliate program; you have to fill out HostMonster Affiliate Tax form in order to be eligible for the payment of your commissions.

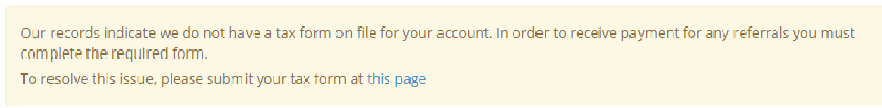

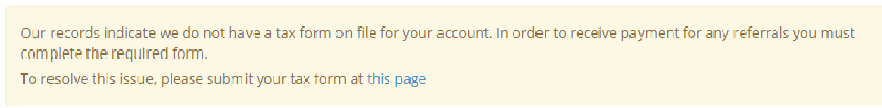

If you didn’t fill out your HostMonster Affiliate Tax form you should be seeing this notice in your affiliate panel:

Our records indicate we do not have a tax form on file for your account. In order to receive payment for any referrals you must complete the required form.

To resolve this issue, please submit your tax form at this page.

How to fill out HostMonster Affiliate Tax form for US. Individuals

If you’re an United States individual follow steps below to fill out your affiliate Tax form:

1) Log into your HostMonster Affiliate panel.

Once you’re logged on you will see the notice mentioned before asking you to fill out the tax form or you can simply go to this URL to start filling your affiliate tax form.

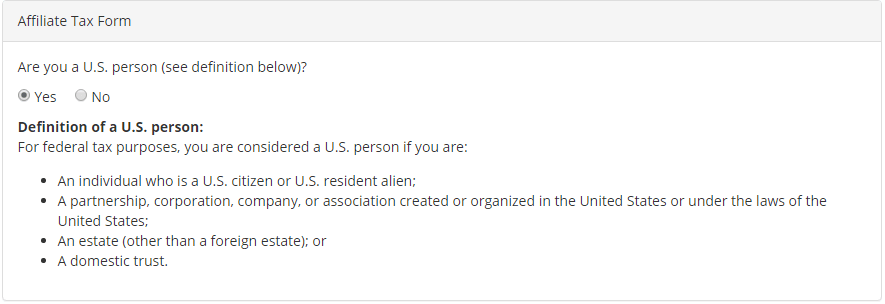

2) Now you will see this checklist:

- W-9 form: For US person or business (citizen, resident alien, corporation, etc.)

- W-8BEN form: For non U.S.Persons

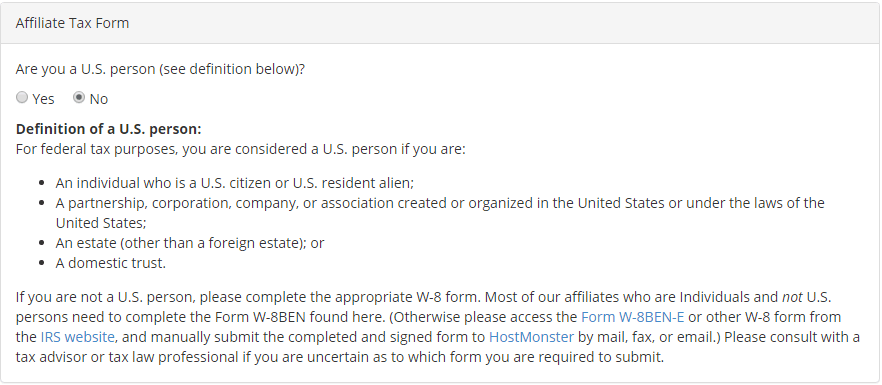

3) If you’re a resident of US. Select “Yes” to fill out “W-9 form”

see definition of US. person below

Definition of a U.S. person:

For federal tax purposes, you are considered a U.S. person if you are:

- An individual who is a U.S. citizen or U.S. resident alien;

- A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States;

- An estate (other than a foreign estate); or

- A domestic trust.

4) Fill out the form with your tax info.

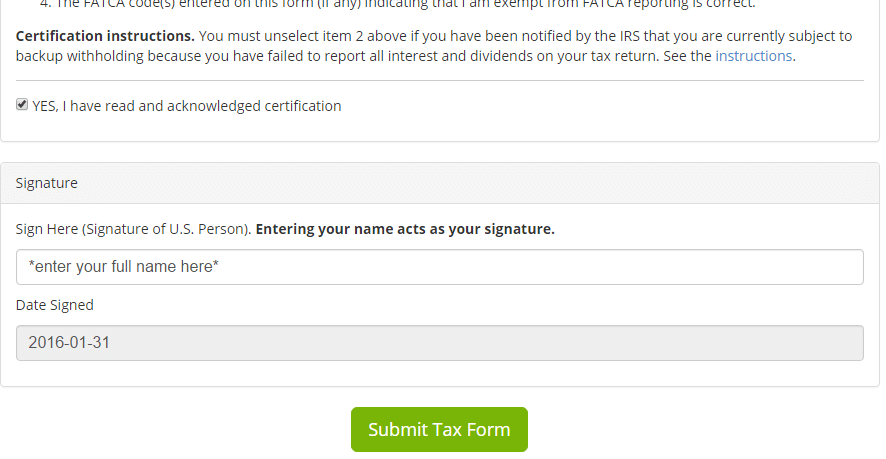

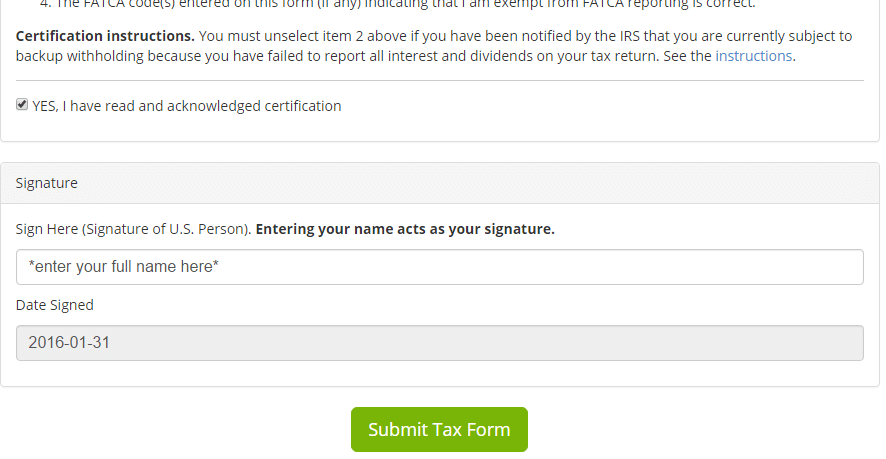

5) Accept the certification

Tick “YES, I have read and acknowledged certification” to accept the certification.

6) Sign the form

Enter your full name as Entering your name acts as your signature.

7) Submit the Tax form

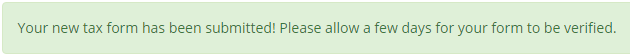

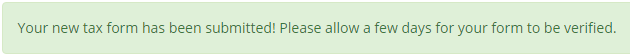

After clicking “Submit Tax Form” you will see a notice saying: “Your new tax form has been submitted! Please allow a few days for your form to be verified.” . Now you’re done submitting your HostMonster Affiliate Tax form. and you will be able to receive any payments from HostMonster Affiliate program.

Filling out HostMonster Affiliate Tax form for Non-US. Individuals

If you are a Non-US HostMonster Affiliate or international internet marketer with no connection with U.S. as a resident, here is the steps you need to follow:

1) Log into your HostMonster Affiliate panel.

Once you’re logged on you will see the notice telling you that you’ve not filled out the tax form; click “this page” link in it, or you can simply go to this URL to start submitting your affiliate tax form.

2) Now you will see this checklist:

- W-9 form: For US person or business (citizen, resident alien, corporation, etc.)

- W-8BEN form: For non U.S.Persons

3) Select Select “No” to fill out “W-8BEN form“

4) Fill out the form with your tax info.

Start with filling out all details like your Name, Address, Type of beneficial owner.

Important: To fill out the EIN number for HostMonster affiliate Tax form, simply add any nine zeros as EIN number (000000000) or any nine numbers.

5) Accept the certification

Tick “YES, I have read and acknowledged certification” to accept the certification.

6) Sign the form

Enter your full name as Entering your name acts as your signature.

7) Submit the Tax form

After clicking “Submit Tax Form” you will see a notice saying: “Your new tax form has been submitted! Please allow a few days for your form to be verified.” . Now you’re done submitting your HostMonster Affiliate Tax form. and you will be able to receive any payments from HostMonster Affiliate program.

Note: I’m not a legal expert, and above-suggested tips are based on my personal experience. This works best for an individual and someone who live outside U.S. or have no connection there.

If you have any more tips and suggestions regard filling out affiliate tax form, Feel free to add them in a comment!

Thanks for Sharing Ahmed, you really helped me a lot I couldn’t find my EIN number while filling the form for the first time and I was afraid that HostMonster won’t accept my tax form and I’ll not be able to receive my balance but it’s accepted now and I will receive my commissions in the next payout period.

Many thanks Ahmed

I’m from India and I couldn’t fill the form before but finally I followed the steps and my tax form was successfully accepted.

Thanks a lot Ahmed, you helped me receiving my affiliate commissions

@Syed

Thanks for sharing your experience with us,

and I’m happy to hear that your Hostmonster tax form has been successfully accepted 🙂